Entourage Health Reports Record First Quarter 2022 Financial Results

Gross revenue* of $17.4 million, up 28% sequentially and 37% year over year

Total revenue of $15.8 million in Q1, 2022 represents a 17% sequential increase over Q4 2021

Gross Profit Before Fair Value Changes improved $5.5 million sequentially

Adjusted EBITDA improved $1.0 million from Q4 2021, reflecting higher gross profit as Company realizes benefits from strategic transformation initiatives

Upsized credit facility with LiUNA Pension Fund provides increased liquidity

Management to host conference call on May 31, 2022, at 10 a.m. Eastern Time

Toronto, Canada, May 30, 2022 – Entourage Health Corp. (TSX-V:ENTG) (OTCQX:ETRGF) (FSE:4WE) (“Entourage” or the “Company”), a Canadian producer and distributor of award-winning cannabis products, announced today its financial results for the three months ended March 31, 2022. The Company reported total revenue of $15.8 million (gross revenue of $17.4 million, before excise duties and discounts), up 17% sequentially over Q4 2021. The Company will host a conference call to discuss its financial and business highlights on Tuesday, May 31, 2022 at 10 a.m. Eastern Time.

“Our first quarter results reflect our strongest operating performance to-date – mainly from fulfilling some of the largest purchase orders in our Company’s history with exemplary delivery rates while consistently producing higher-grade cannabis at higher efficiencies. All of this contributed to notable increases in our adult-use and medical sales – up over 35% from last year,” said George Scorsis, CEO and Executive Chair, Entourage. “Since implementing our strategic transformation initiatives, we have achieved sequential revenue growth and cost improvements. These initiatives continue to produce tangible benefits, including 22% gross margin expansion during the quarter. With our improved liquidity position and financial flexibility thanks to our expanded credit facilities and lenders’ support, we have the resources to continue creating long-term value for all our stakeholders.”

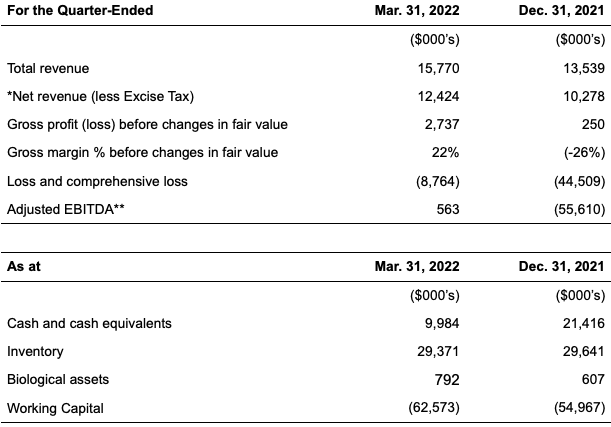

Summary of Results

*Net revenue defined as revenue (i.e., gross revenue less discounts and customer incentives but inclusive of freight) less excise taxes

**Adjusted EBITDA is not a recognized measurement under International Financial Reporting Standards (“IFRS”) and this data may not be comparable to data presented by other companies. Management defines Adjusted EBITDA as EBITDA adjusted to exclude interest, tax, and depreciation, stock compensation, fair value changes and other non-cash items, and non-recurring items. This data is furnished to provide additional information and does not have any standardized meaning prescribed by IFRS. The Company uses this non-IFRS measure to provide shareholders and others with supplemental measures of its operating performance. The Company also believes that securities analysts, investors and other interested parties, frequently use this non-IFRS measure in the evaluation of companies, many of which present similar metrics when reporting their results. As other companies may calculate Adjusted EBITDA differently than the Company, this metric may not be comparable to similarly titled measures reported by other companies. We caution readers that Adjusted EBITDA should not be substituted for determining net loss as an indicator of operating results, or as a substitute for cash flows from operating and investing activities. See the Company’s management’s discussion and analysis for the three months ended March 31, 2022 (the “Q1 2022 MD&A”) for a detailed reconciliation of Adjusted EBITDA to Net Income / (Loss). The Company’s financial statements for the three months ended March 31, 2022 and the Q1 2022 MD&A are available on SEDAR at www.sedar.com.

“Our focus on driving sales for top-performing products while rigorously adhering to our enhanced financial discipline will support our future growth even as we continue to strengthen our balance sheet,” said Vaani Maharaj, CFO, Entourage. “Revenue from all our sales channels is consistently growing, driven by expanded product availability across retail outlets, broader distribution channels, consistent flow-through of higher-margin products and customer-patient acquisition initiatives. By continuing to improve our operating efficiencies in 2022, we fully expect to see expanded margins while we continue to propel revenue growth through increased sales and market share gains.”

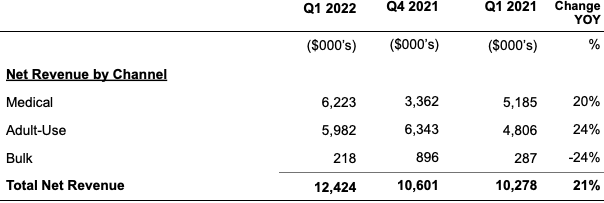

Revenue Highlights

First Quarter 2022 Financial Highlights

For the quarter ended March 31, 2022, Entourage recorded gross revenue of $17.4 million, and net revenue of $15.8 million less excise tax for total net revenues of $12.4 million compared to $10.6 million for the quarter ended December 31, 2021, a 17% sequential increase and 21% year-over-year improvement.

Gross profit before changes in fair value was $2.7 million for Q1 2022, representing an increase in profit of $2.5 million or 992% due to improved efficiencies and partly due to lower inventory write-downs in Q1 2022.

Gross margins of 22% in Q1 2022 compared to (-8%) for Q4 2021 and 2.4% in Q1 2021, the improvement over the prior periods a result of lower cost to produce higher grade products, sold at higher margins across expanded distribution channels.

The weighted average cost per gram from clone to harvest of plants on hand was $0.52 in Q1 2022 compared to $0.63 in Q4, 2021. Weighted average cost per gram of inventory on hand decreased to $0.51 in Q1 2022 compared to $0.66 in Q4, 2021 mainly due to the reduced cost of operations.

Adjusted EBITDA improved by $1.0 million to $563,000 in Q1, 2022, compared with negative $(432,000) in Q4, 2021, also primarily driven by strategic transformation initiatives to lower costs and partly due to generating higher-margin revenue and spending lower selling, general and administrative expenses.

Corporate Highlights During and Subsequent to First Quarter 2022

Executive appointments included naming Executive Chairman, George Scorsis, as permanent CEO in January 2022; and the appointment of veteran finance executive Vaani Maharaj as CFO in April 2022.

The Company announced in March 2022 that it secured an extension of the maturity date of its credit facilities from March 28, 2022 to May 31, 2022, and a deferral of certain of its financial covenants to May 31, 2022.

The Company announced that pre-roll products in cultivars Mango Haze and Pedro Sweet Sativa continue to be top-sellers in BC with 10-pack pre-roll products – leading to new cultivars Black Sugar Rose and Blueberry Seagal being introduced as 10-pack pre-roll products in 2022.

Also in early 2022, Entourage launched Pedro’s Sweet Sativa Live Sugar and new cultivar Space Cake.

Color Cannabis brand refresh debuted in March 2022 centered around Color Theory meant to educate consumers on the correlation between the colour associated with a particular strain and its potential effect on moods.

The Company partnered with Cannabis Amnesty in March 2022 to launch “Joints for Justice” retail campaign to raise awareness and funds with $1 of every Royal City Cannabis Co. pre-roll sold going to the advancement of Cannabis Amnesty’s initiatives.

On April 29, 2022, Entourage and LiUNA Pension Fund announced the further upsizing of its existing credit facility with an additional $15 million in funding availability. This non-dilutive funding will be used for general working purposes to drive further commercial growth.

In May 2022, Entourage announced it has entered into an agreement with Pineapple Express – a wholly owned subsidiary of Fire & Flower Holdings Corp. – to launch same-day/next-day medical cannabis delivery services to the Company’s Starseed Medicinal patients.

Also in May 2022, the Company entered into voting support agreements with certain holders of its 8.5% unsecured convertible debentures, and it announced proposed amendments to the same, to be voted on at a meeting of debentureholders scheduled for June 20, 2022.

Later in May, Entourage announced the Canadian debut of The Boston Beer Company’s (BBC) new cannabis-infused iced tea beverages ‘TeaPot’. Entourage will be the exclusive distributor of TeaPot to local retailers in Canada. Launching in select provinces as of July 2022, TeaPot is the first non-alcoholic, infused beverage crafted in partnership with Boston Beer’s cannabis subsidiary BBCCC Inc., and Peak Processing, its bottling partner.

Conference Call Details:

A conference call will be hosted by Mr. Scorsis and Ms. Maharaj, with management available for questions following opening remarks as follows:

Date:

Tuesday, May 31, 2022

Time:

10 a.m. Eastern Time

Dial-in Number:

Canada/USA: 1-800-319-4610. International Toll: 1-604-638-5340

Participants, please dial in and ask to join the Entourage call

Replay Dial-in:

Canada/USA: 1-800-319-6413. International Toll: 1-604-638-9010

Replay Access Code: 9003

Available after 12:00 p.m. Eastern Time, until June 30, 2022

To read Entourage’s recent Shareholder Newsletter 2022, visit our website here. To access our corporate video, visit us here and to access our latest investor presentation and corporate deck here.

About Entourage Health Corp.

Entourage Health Corp. is the publicly traded parent company of Entourage Brands Corp. (formerly WeedMD RX Inc.) and CannTx Life Sciences Inc., licence holders producing and distributing cannabis products for both the medical and adult-use markets. The Company owns and operates a state-of-the-art hybrid greenhouse and processing facility located on 158-acres in Strathroy, ON; a fully licensed 26,000 sq. ft. Aylmer, ON processing facility, specializing in cannabis extraction; and a micropropagation, tissue culture and genetics centre-of-excellence in Guelph, Ontario. With its Starseed Medicinal medical-centric brand, Entourage has expanded its multi-channeled distribution strategy. Starseed’s industry-first, exclusive partnership with LiUNA, the largest construction union in Canada, along with employers and union groups complements Entourage’s direct sales to medical patients. Entourage’s elite adult-use product portfolio includes Color Cannabis, Saturday Cannabis and Royal City Cannabis Co. – sold across eight provincial distribution agencies. The Company also maintains strategic relationships in the seniors’ market and supply agreements with Shoppers Drug Mart. It is the exclusive Canadian producer and distributor of award-winning U.S.-based wellness brand Mary’s Medicinals sold in both medical and adult-use channels. Under a collaboration with The Boston Beer Company subsidiary, Entourage is also the exclusive distributor of cannabis-infused beverages in Canada, expected to launch in 2022.

Follow Entourage and its brands on LinkedIn

Twitter: Entourage, Color Cannabis, Saturday Cannabis, Starseed & Royal City Cannabis Co.

Instagram: Entourage, Color Cannabis, Saturday Cannabis, Starseed & Royal City Cannabis Co.

For further information, please contact:

For Investor Enquiries:

Valter Pinto

Managing Director

KCSA Strategic Communications

1-212-896-1254

entourage@kcsa.com

investor@entouragecorp.com

For Media Enquiries:

Marianella delaBarrera

SVP, Communications & Corporate Affairs

416-897-6644

marianella@entouragecorp.com

Forward Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation which are based upon Entourage's current internal expectations, estimates, projections, assumptions and beliefs and views of future events. Forward-looking information can be identified by the use of forward-looking terminology such as "expect", "likely", "may", "will", "should", "intend", "anticipate", "potential", "proposed", "estimate" and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions "may", "would" or "will" happen, or by discussions of strategy.

The forward-looking information in this news release is based upon the expectations, estimates, projections, assumptions and views of future events which management believes to be reasonable in the circumstances. Forward-looking information includes estimates, plans, expectations, opinions, forecasts, projections, targets, guidance or other statements that are not statements of fact. Forward-looking information necessarily involve known and unknown risks, including, without limitation, risks associated with general economic conditions; adverse industry events; loss of markets; future legislative and regulatory developments; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the cannabis industry in Canada generally; the ability of Entourage to implement its business strategies; the COVID-19 pandemic; competition; crop failure; and other risks.

Any forward-looking information speaks only as of the date on which it is made, and, except as required by law, Entourage does not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Entourage to predict all such factors. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in Entourage’s disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR at www.sedar.com. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE