Entourage Health Reports Fiscal Year 2022 Financial Results and Posts $54.5 Million in Total Revenues

The Company positions its 2023 business outlook to drive profitability and deliver enhanced product offerings, paving the way for long-term sustainability.

Record net medical revenue of $17.4 million for 2022, representing 16% growth

Entourage secured a 5% share of total sales, ranking them the fourth spot of national pre-roll sales in 2022

Upsized credit facility with LiUNA Pension Fund Central and Eastern Canada (“LPF”) improves liquidity position

Toronto, Canada, May 1, 2023 – Entourage Health Corp. (TSX-V:ENTG) (OTCQX:ETRGF) (FSE:4WE) ("Entourage" or the "Company"), a Canadian producer and distributor of award-winning cannabis products, announced today its financial results for the fiscal year ended December 31, 2022.

“Attaining success in the cannabis market requires a two-fold approach, which involves producing high-quality products that foster customer loyalty while also implementing sound financial management practices that enable sustainable business growth," stated George Scorsis, CEO and Executive Chairman. "By adopting an asset-light model, we are focusing on investing in strategic partnerships and executing a strong business plan that prioritizes enhanced efficiency and cost accountability. This approach will enable the Company to focus on its core competencies, establishing a strong brand presence within the constantly evolving cannabis industry.”

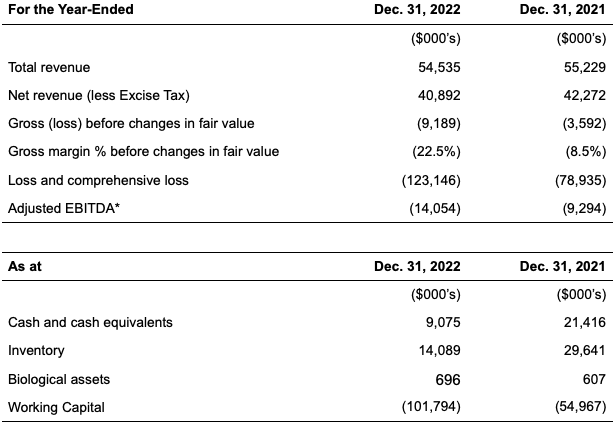

Summary of Results

*Adjusted EBITDA is not a recognized measurement under International Financial Reporting Standards (“IFRS”) and this data may not be comparable to data presented by other companies. Management defines Adjusted EBITDA as EBITDA adjusted to exclude interest, tax, and depreciation, stock compensation, fair value changes and other non-cash items, and non-recurring items. This data is furnished to provide additional information and does not have any standardized meaning prescribed by IFRS. The Company uses this non-IFRS measure to provide shareholders and others with supplemental measures of its operating performance. The Company also believes that securities analysts, investors and other interested parties, frequently use this non-IFRS measure in the evaluation of companies, many of which present similar metrics when reporting their results. As other companies may calculate Adjusted EBITDA differently than the Company, this metric may not be comparable to similarly titled measures reported by other companies. We caution readers that Adjusted EBITDA should not be substituted for determining net loss as an indicator of operating results, or as a substitute for cash flows from operating and investing activities. See the Company’s management’s discussion and analysis for the 12 months ended December 31, 2022 (the “2022 MD&A”) for a detailed reconciliation of Adjusted EBITDA to Net Income / (Loss). The Company’s financial statements for the 12 months ended December 31, 2022, and the 2022 MD&A are available on SEDAR at www.sedar.com.

Full Year 2022 Financial Highlights

For the fiscal year ended December 31, 2022, Entourage recorded total revenue of $54.5 million, compared to approximately $55.2 million for the fiscal year ended December 31, 2021, a 1% decrease year-over-year.

Cost of Goods Sold (COGS) was $50.1 million, representing an increase of $4.2 million compared to the previous year. The increase is mainly due to higher provisions resulting from the destruction of inventory and write downs of the fair value of biological assets, which accounted for $14.3 million of COGS during the period, a 18% decline compared to the previous year.

Gross loss before changes in fair value was ($9.2 million) for the full year of 2022 versus a gross loss of ($3.6 million) for the full year of 2021. The deceleration in gross profit was partly tied to revenue streams adversely affected by the supply shortages of proprietary cultivars from April to September. Additionally, the Company incurred significant overhead and investment costs to address mechanical equipment issues that caused the shortages, resulting in further losses.

Selling, General & Administrative (SG&A) expenses for 2022 totalled $30.3 million, compared to $28.7 million in 2021 and $8.9 million in Q4 2022. The increase was primarily due to the implementation an organization-wide restructuring plan aimed at optimizing the Company’s operations and reducing costs. As part of these efforts, the Company identified certain facilities and equipment that are no longer necessary for its operations and made the decision to decommission them. This resulted in the recognition of decommissioning costs, which had a negative impact on the Company’s performance in the quarter.

The Company's 2022 Adjusted EBITDA of ($14.1 million) decreased 51% compared to the previous year, mainly due to increases in property, plant and equipment impairments, one-time sales expenses, costs to sell assets held for sale, and provisions for the destruction and write down of inventory, and decommissioning activities.

The Company is committed to achieving Adjusted EBITDA profitability during the 2023 fiscal year by focusing on cost containment and strategic rationalizations. Transformation plans were designed to realize over $12.0 million in annualized savings, which will be achieved through a 35% reduction in staff (and affiliated channels) representing over $6.0 million in annualized savings, decommissioning of cultivation and extraction facilities representing $5.4 million in annualized savings, and a strategic realignment of SG&A representing over $1.1 million in annualized savings.

“Despite encountering revenue stagnation in 2022 because of a product shortfall last spring, initial indications imply that the partnership with HEXO, our third-party supplier, is producing a positive impact on overall operations," stated Vaani Maharaj, Chief Financial Officer of Entourage Health. "Additionally, we have implemented several measures to review and optimize our cost structure, focusing on disciplined cash and inventory management and greater operational cost improvements. We anticipate these efforts will result in approximately $12.0 million in annualized cost savings. The infusion of $30.0 million in financing from LPF and deferred debt payments has strengthened our Company's liquidity and provided additional support for our operations and growth initiatives. This financial boost positions us to pursue new projects, expand our market presence, and implement other growth strategies to create shareholder value and strengthen our balance sheet in 2023."

Corporate Highlights Year End December 31, 2022

Leadership Appointments

Appointment of Chief Financial Officer

In May 2022, Vaani Maharaj, a seasoned financial executive with broad experience in corporate finance, healthcare and consumer-packaged goods, joined the Company as Chief Financial Officer.

Appointment of Chief Operating Officer

In September 2022, James Afara, a results-driven leader with over 15 years of operations and supply chain experience, accepted the position as the Company’s Chief Operating Officer.

Business Milestones

In May 2022, Entourage announced it had entered into an agreement with Pineapple Express – a wholly owned subsidiary of Fire & Flower Holdings Corp. – to launch same-day/next-day medical cannabis delivery services to the Company’s Starseed Medicinal patients.

In July 2022, Entourage announced the expansion of its medical offerings with the launch of new services, signing with HelloMD, a telehealth network to support the high volume of patient consultations.

In August 2022, Entourage announced it entered into an exclusive licensing agreement with U.S.-based Irwin Naturals, renowned nutraceuticals and herbal supplement formulator. Under the agreement, Entourage will produce and distribute Irwin Naturals Cannabis products in Canada.

In September 2022, Entourage launched Syndicate Cannabis a direct-to-patient medical cannabis marketplace showcasing a portfolio of premium craft cannabis products sourced both in-house and from third-party micro-cultivators and producers.

On November 15, 2022, Entourage announced it had executed a long-term cannabis supply agreement with HEXO Corp. (“HEXO”), a leading producer of high-quality cannabis products. Under the agreement, HEXO will provide bulk biomass to be processed at Entourage’s Aylmer facility and marketed to patients and consumers under Entourage’s family of brands.

Financing and Credit Facilities

In March and May 2022, the Company announced that it secured an extension of the maturity date of its senior secured credit facility (the “Senior Facility”) from March 28, 2022, to June 30, 2022, and a deferral of certain of its financial covenants, subject to conditions.

In April 2022, Entourage and LPF announced the upsizing of its previously announced credit facility (the “LPF Facility”) with an additional $15 million of non-dilutive financing.

In June 2022, Entourage and LPF announced the upsizing of the LPF Facility adding an additional $8.9 million in non-dilutive funding availability. This funding was used to repay the amended convertible debentures which expired on June 27, 2022.

In July 2022, pursuant to certain amendments to the Senior Facility and the LPF Facility, Entourage secured an extension of the maturity date for the Senior Facility from June 30, 2022 to June 30, 2024, and of the LPF Facility from August 15, 2022 to December 31, 2024, subject to certain conditions.

In October 2022, Entourage and LPF announced the upsizing of the LPF Facility by an additional $30 million. The LPF Facility will be used by Entourage for general working capital purposes as the Company continues to execute its commercial goals to achieve sustainable, profitable growth.

Sales and Marketing Milestones

In 2022, 37 products were launched across six different geographical markets, resulting in a total of 61 unique SKUs introduced, spanning from infused pre-rolls to new cultivars and large format flower. Starseed and Syndicate introduced 14 new SKUs to the medical channel.

Entourage secured the fourth position for national pre-roll sales, accounting for 5% of the total sales. Additionally, it ranked second in British Columbia, accounting for 11% of the pre-roll market share. (Source: Buddi)

In conjunction with The Boston Beer Company, Inc., ‘TeaPot’, a new line of cannabis-infused iced tea beverages debuted across Canada.

Net medical revenue was $17.4 million, a 16% increase driven by growth in insured patient registrations and continued expansion of product offerings.

In September 2022, Starseed accounted for 5.7% of active client registrations. Additionally, their share of unit sales for 2022 up until September exceeded 7%. (Data: Health Canada)

Entourage signed five new union groups to its Starseed Medicinal program in partnership with leading benefits provider Union Benefits – group benefits administrator to over 12,000 members. With these additions, Entourage confirms it has 11 union groups, five insurance providers and 24 clinics under agreement for preferred medical cannabis coverage.

The average renewal rate for Starseed medical patients was over 95%, indicating a high level of satisfaction and trust among customers towards the quality of the services provided.

Starseed debuted a first-of-its-kind digital Patient Treatment Plan as a set of core offerings available to registered patients looking for tailored products along with practical dosing guidelines based on recommendations from a healthcare practitioner. With the launch, Starseed is the first known provider to offer standardized dosing regimens.

Company Outlook

Entourage Health has set key priorities for 2023:

With a strong commitment to delivering exceptional cannabis products, Entourage has unveiled its business outlook for the year 2023, focusing on greater shareholder return, centred around two key pillars: profitability and quality products.

Profitability is a key focus of the Company's 2023 business outlook, and the recent transition to a third-party supplier is expected to improve its overall financial health. By achieving higher margins, Entourage will have greater flexibility to allocate its capital resources towards sales, marketing, and innovation initiatives, which can ultimately strengthen Entourage's brand presence and drive the Company's growth forward.

While the first pillar focuses on one aspect of the Company’s strategy, the second is equally essential and centres around Entourage’s commitment to delivering quality products. Recognizing that customer satisfaction is paramount to sustained success, the Company aims to uphold the highest product quality and reliability standards. By prioritizing product excellence, Entourage seeks to differentiate itself in the market, build customer trust, and drive repeat business by implementing effective marketing strategies to foster brand loyalty.

Entourage is confident that its product quality, offerings, and brand positioning will increase net revenue, gross profit, and adjusted EBITDA throughout 2023. With a steady cost base, this projected growth will improve operating leverage, positioning Entourage as a leading player in the industry going forward.

The Company will defer the earnings call for the fourth quarter and fiscal year 2022 to align with the first quarter 2023 earnings results on or before May 30, 2023.

About Entourage Health Corp.

Entourage Health Corp. is the publicly traded parent Company of Entourage Brands Corp. and CannTx Life Sciences Inc., licence holders producing and distributing cannabis products for both the medical and adult-use markets. The Company owns and operates a state-of-the-art hybrid greenhouse and processing facility located on 158-acres in Strathroy, ON; a fully licensed 26,000 sq. ft. Aylmer, ON processing facility. With its Starseed Medicinal medical-centric brand, Entourage has expanded its multi-channeled distribution strategy. Starseed’s industry-first, exclusive partnership with LiUNA, the largest construction union in Canada, along with employers and union groups complements Entourage’s direct sales to medical patients. With the launch of Syndicate, Entourage now hosts another unique medical marketplace that offers patients a collective of Canadian micro-cultivators’ products, along with Entourage’s family of brands. Entourage’s elite adult-use product portfolio includes Color Cannabis and Saturday Cannabis – sold across eight provincial distribution agencies. It is the exclusive Canadian producer and distributor of award-winning U.S.-based wellness brand Mary’s Medicinals sold in both medical and adult-use channels. Under a collaboration with The Boston Beer Company subsidiary, Entourage is also the exclusive distributor of cannabis-infused beverages ‘TeaPot’ in Canada, which launched in summer 2022, starting in select provinces. In addition, Entourage also entered into an exclusive agreement with Irwin Naturals, a renowned nutraceutical and herbal supplement formulator of popular branded wellness products sold across North America. The new line of CBD soft gels is now available on Starseed’s medical platform.

Follow Entourage and its brands on LinkedIn

Twitter:

Entourage, Color Cannabis, Saturday Cannabis, Starseed & Syndicate

Instagram:

Entourage, Color Cannabis, Saturday Cannabis, Starseed & Syndicate

For additional information, or investor or media inquiries:

Catherine Flaman

Senior Director, Communications & Corporate Affairs

416-910-0279

catherine.flaman@entouragecorp.com

Forward Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation which are based upon Entourage's current internal expectations, estimates, projections, assumptions and beliefs and views of future events. Forward-looking information can be identified using forward-looking terminology such as "expect", "likely", "may", "will", "should", "intend", "anticipate", "potential", "proposed", "estimate" and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions "may", "would" or "will" happen, or by discussions of strategy.

The forward-looking information in this news release is based upon the expectations, estimates, projections, assumptions, and views of future events which management believes to be reasonable in the circumstances. Forward-looking information includes estimates, plans, expectations, opinions, forecasts, projections, targets, guidance, or other statements that are not statements of fact. Forward-looking information necessarily involve known and unknown risks, including, without limitation, risks associated with general economic conditions; adverse industry events; loss of markets; future legislative and regulatory developments; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the cannabis industry in Canada generally; the ability of Entourage to implement its business strategies; the COVID-19 pandemic; competition; crop failure; and other risks.

Any forward-looking information speaks only as of the date on which it is made, and, except as required by law, Entourage does not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Entourage to predict all such factors. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in Entourage’s disclosure documents filed with the applicable Canadian securities' regulatory authorities on SEDAR at www.sedar.com. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE